“Hello John. Last week, for the first time in many years, I pulled a copy of my credit reports from all three of the credit reporting agencies.

It looks considerably different than it did in 2006 but I thought most of the differences were cosmetic. I was wrong.

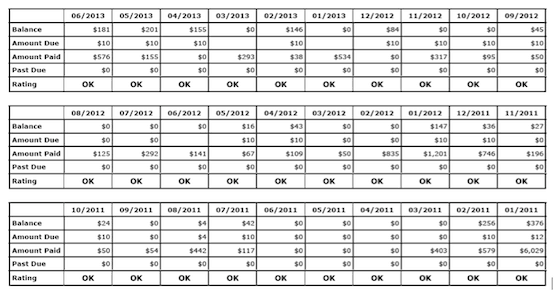

I see that they credit bureaus are now reporting the exact amount I paid on my credit card bills for each month going back several years.

Is that new?”

Time Series Payment Data

It’s relatively new, yes. What you’re referring to is called Time Series Payment Data or, in English, historical payment data.

If you pulled your credit reports a few years ago you didn’t see it. If you pull your credit reports today, it’s all over the place.

Advertisement

As it pertains to balances, traditionally the credit bureaus only reported the balance on your account and the past due amount, if any.

The balance wasn’t real time, meaning it wasn’t actually your balance as of the date of your credit report.

Instead the balance was accurate as of your prior month’s statement.

So, the balance on your most recent statement was also the balance that ended up on your credit reports.

Of course by the time your statement showed up the balance was already outdated.

You may have made a payment, charged something new, had interest or fees applied, or received a credit for returned merchandise.

This limitation made it hard for anyone reviewing your credit reports (lenders and credit scoring models) to tell if you paid your balance in full and re-used your card or if you carried a balance from the prior month.

The new “Amount Paid” data eliminates that problem.

Now it’s very easy for anyone or anything reviewing your credit report to quickly tell if you are what’s referred to as a “revolver” or a “transactor.”

A revolver is someone who pays less than the full balance and carries some amount of his or her balance over to the next month.

A transactor is someone who uses his or her credit card but pays it in full before the due date.

The only reason a transactor has balances month after month is because they use their cards month after month.

Why is this important?

You should be aware of this new data and especially how it will likely be used.

It doesn’t take a rocket scientist to figure out that people who pay their cards in full each month aren’t as risky as those who revolve a balance.

In fact TransUnion, one of the three major credit reporting agencies, quantified the value of the information in a study last year.

They found that people who carry a balance on their cards are 3 times as risky on newly opened credit accounts and 5 times as risky on existing credit accounts compared to those who do not carry a balance.

And while the historical payment history data is not being considered by today’s credit scoring models yet because it’s too new, it’s really just a matter of time.

According to a TransUnion spokesperson, “We are now just coming out with credit scores that do incorporate the information, and we find that they have massive predictive power improvements over traditional credit scores.”

What this means for you is there’s another reason to not carry a balance on your credit card.

Not only is it likely to be the most expensive debt you’ll ever carry but now it will end up lowering your credit scores.

John Ulzheimer is the Credit Expert at CreditSesame.com, and a credit blogger at Mint.com, CreditCardInsider.com and the National Foundation for Credit Counseling. He is an expert on credit reporting, credit scoring and identity theft. Formerly of FICO and Equifax, John is the only recognized credit expert who actually comes from the credit industry. The opinions expressed in his articles are his and not of Mint.com or Intuit. You can follow John on Twitter here.

Comment